Category: D.TAX

-

Deductions allowed from Income from House Property?

Any income received in related to house property is taxable. According to Income Tax Act, 1961 a person receiving income from house property can deduct certain amount under section 24 as standard deduction (other than municipal tax paid in the case of let out property) from the income from house property.

-

What is Gross and Net Tax Collection

In Tax collection reports,you may notice that amount of gross and net tax collection differs. The difference in gross and net collections is due to tax refunds. Income Tax Department will refund the excess tax paid on account of mistake/mis calculation by the tax payers.

-

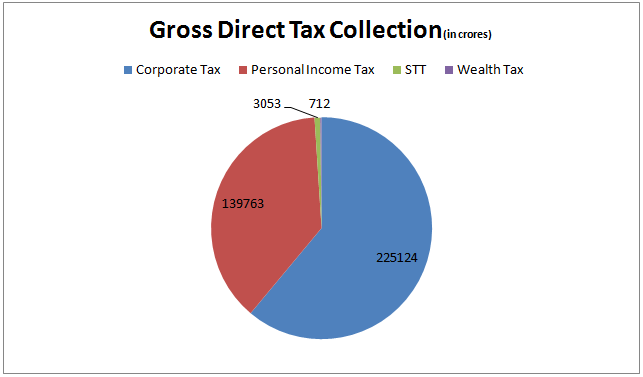

What is major source of Tax Revenue

As tax collection increased during April-November of the Financial Year 2013-14, corporate tax contribute a major share to gross direct tax collection. Even during the period of sluggish market gross corporate tax collection amounts to Rs…..

-

Direct Tax up 13.18 %, Corporate Tax up by 9.66 %, Wealth 13.38 %

As Tax Authorities became smart and Tax Payers become responsible citizens, aggregate Tax collection rised! Gross direct tax collection during April-November of the F.Y. 2013-14 is up by 13.18 percent at Rs.3,68,655 crore as against Rs.3,25,736 crore in the same period last year. While gross collection of Corporate taxes has shown an increase of 9.66…

-

Let out your house property-get exemption from Wealth Tax

Let out your house property to get exemption from wealth tax There has been several instances where peoples having two or more residential houses unoccupied. In such cases they may have to pay wealth tax on such property too even it is not utilized. Wealth tax is charged on the net wealth of a person…

-

Tax Slab in India 2013-14-Individual

Tax slab Rates of individual for the Fy 2013-2014.In case of Individual (including women) whose age is not more than sixty years.,resident individual who is of the age of sixty years or more but not more than the age of eighty years during the previous year and In case of individual who is of the…

-

Govt set up Tax Administration Reform Commission (TARC)

TAARC functions to review the existing mechanism and recommend appropriate organizational structure for tax governance with special reference to deployment of workforce commensurate with functional requirements, capacity building,vigilance administration, responsibility and accountability of human resources, key performance indicators, assessment, grading and promotion systems,

-

Authorized banks for e-payment procedure

e-Payment facilitates payment of direct taxes online by taxpayers. To avail of this facility the taxpayer is required to have a net-banking account with any of these Authorized Banks.

-

RBI appeals to pay Income Tax in advance

The Reserve Bank of India has appealed to public to avoid last minute rush and remit their Income-tax dues sufficiently in advance of the due date of September 30, 2013. It has also urged the assessees to take advantage of paying taxes at select branches of accredited agency banks which have been authorised to accept…

-

Is saving account interest is taxable?

With effect from assessment year 2013-2014,a new section 80TTA hasbeen introduced for providing deduction for interest income.sec. 80TTA provides that, any interest income derived from deposits in a savings account (not time deposits) will be allowed as deduction. Interest income up to Rs 10,000 in aggregate shall be allowed as deduction while computing Total Income.…