Author: SREENU .T

-

What is ACES?

Automation of Central Excise and Service Tax (ACES) is the e-governance initiative by Central Board of Excise and Customs (CBEC), Department of Revenue, Ministry of Finance. It is one of the Mission Mode Projects (MMP) of the Govt. of India under National e-Governance Plan (NeGP).

-

80EE Deduction on loan taken for Residential House Property

With effect from 1st April 2014 a new section has been introduced to allow deduction in respect of interest on loan taken for acquisition of residential house property. Deduction is allowed up to a maximum of Rs one lakh rupees…

-

Rebate of Income Tax u/s 87A

Rebate of income-tax in case of certain individuals (87A) With effect from the 1st day of April, 2014, An assessee, being an individual resident in India, whose total income does not exceed five hundred thousand rupees, shall be entitled to a deduction, from the amount of income-tax (as computed before allowing the deductions under this…

-

Conditions to get waiver of interest

Three conditions specified in Section 220 (2A) of the Income Tax Act should be cumulatively satisfied by an assessee to claim waiver of interest levied under Section 220 (2) of the Act.

-

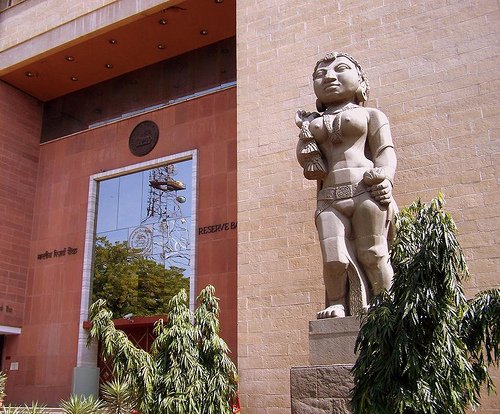

RBI Governor’s and their tenure

Few personalities are so close yet so distant to India’s populace as the Governor of the Reserve Bank and few evocative of his awe and mystique: close, because virtually every individual, be he ever so poor or so rich, carries on his person……

-

Dr Raghuram Rajan-23rd RBI Governor

Dr. Raghuram Rajan assumed charge as the 23rd Governor of the Reserve Bank of India on September 4, 2013. Prior to this, he was the Chief Economic Advisor, Ministry of Finance, Government of India and the Eric J. Gleacher Distinguished Service Professor of Finance at the University of Chicago’s Booth School. Between 2003 and 2006,…

-

Limit for e payment reduced to 1 lakh

Ministry of Finance (department of revenue),has reduced the threshold limit for payment of service tax to 1 lakh rupees. Previously it was Rs 10 lakh for e-payment. It shall come into force from 1st January 2014. It is observed that the move is towards encouraging tax compliances through online mode and thus to make formalities…

-

Who is a Representative Assessee

in respect of the income of a non-resident specified in sub-section (1) of section 9, the agent of the non-resident, including a person who is treated as an agent under section 163,in respect of the income of a minor, lunatic or idiot, the guardian or manager who is entitled to receive or is in receipt…

-

What is the Limit For Audit of Books Of Account

Every person,carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year ; or carrying on profession shall, if his gross receipts in profession exceed twenty-five lakh rupees….