Category: Ministry of Finance

-

Hidden Benefits of housing loan you must read

Housing loan, in first instance it is like a burden to repay a certain amount to be paid in periodical intervals even though it is used for construction/purchase of house. But, when it comes to Tax calculation it will be beneficial to tax payer that, he can deduct the interest paid on account of housing…

-

Take advantage from housing loan interest!!

According to Income Tax Act, 1961 a person receiving income from house property can deduct certain amount under section 24 as standard deduction (other than municipal tax paid in the case of let out property) from the income from house property. Standard deduction prescribed under section 24 is as follows In the case of…

-

Deductions allowed from Income from House Property?

Any income received in related to house property is taxable. According to Income Tax Act, 1961 a person receiving income from house property can deduct certain amount under section 24 as standard deduction (other than municipal tax paid in the case of let out property) from the income from house property.

-

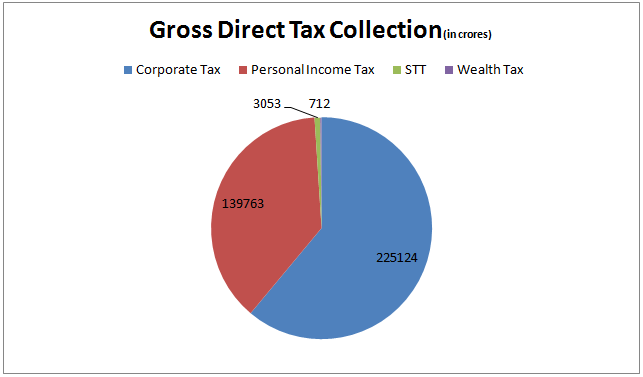

What is Gross and Net Tax Collection

In Tax collection reports,you may notice that amount of gross and net tax collection differs. The difference in gross and net collections is due to tax refunds. Income Tax Department will refund the excess tax paid on account of mistake/mis calculation by the tax payers.

-

What is major source of Tax Revenue

As tax collection increased during April-November of the Financial Year 2013-14, corporate tax contribute a major share to gross direct tax collection. Even during the period of sluggish market gross corporate tax collection amounts to Rs…..

-

Direct Tax up 13.18 %, Corporate Tax up by 9.66 %, Wealth 13.38 %

As Tax Authorities became smart and Tax Payers become responsible citizens, aggregate Tax collection rised! Gross direct tax collection during April-November of the F.Y. 2013-14 is up by 13.18 percent at Rs.3,68,655 crore as against Rs.3,25,736 crore in the same period last year. While gross collection of Corporate taxes has shown an increase of 9.66…

-

What is Form-15G and 15H?

According to section 194A of Income Tax Act, 1961 TDS is to be deducted if the interest paid by a bank on account of FD exceeds Rs 10,000. If the income of assessee does not fall into tax limit, he can submit a Declaration Form 15G/15H to bank stating that he doesn’t have any taxable…

-

Find Out-Professional Tax &Professional Tax Slab Rate

Professional Tax is the tax charged by the state governments in India. Professional tax is levied from salaried employees or practicing professionals or persons engaged in any trade etc. Employers are liable to deduct professional tax from salary/wage and depositing the same to the concerned local body/authority and in other cases, persons themselves shall pay…

-

All services relating to education are exempt from service tax

Directorate of Service Tax, by a circular (No.172/7/2013) clarified that all services relating to education are exempt from service tax. Such services include providing hostels, transportation, housekeeping, security services, canteen, etc to educational institutions. For example, if a school hires a bus from a transport operator in order to ferry students to and from school,…

-

Unlisted companies can opt for overseas listing-says Ministry of Finance

Unlisted companies can opt for overseas listing Ministry of Finance has allowed unlisted companies which are incorporated In India to opt for listing abroad and to raise funds without the requirement of prior listing in India. The scheme is allowed for an initial period of two years on a pilot basis. The approval to…