Category: Ministry of Finance

-

Gross Direct Tax collection up by 13.27 per cent

Gross direct tax collections during April-July of the Financial Year 2013-2014 is up by 13.27 percent at Rs. 1,57,169 crore as against Rs. 1,38,751crore in the same period last year. While gross collection of Corporate taxes has shown an increase of 9.75 percent and stands at Rs. 92,115 crore during April-July in F.Y. 2013-2014 as…

-

Overwhelming response to e-filing of ITR

The due date for filing of Income Tax Return for Individuals, HUFs and non-auditable cases for A.Y. 2013-14 was extended by the Central Board of Direct Taxes(CBDT)from 31st July to 5th August, 2013 as there was an overwhelming response to e-filing from every corner of the country. 123.03 lakh returns have been e-filed till 5th…

-

DR. RAGHURAM RAJAN new GOVERNOR of RESERVE BANK OF INDIA

DR. RAGHURAM RAJAN has been appointed as Governor of Reserve Bank of India (RBI) for a term of three years. Currently Dr. Raghuram Rajan is acting as Chief Economic Adviser, Ministry of Finance. Dr. Raghuram Rajan is appointed in the place of retiring Governor Dr. D Subba Rao upon completion of his tenure. Dr. Raghuram…

-

Default in depositing TDS before due dates will leads to prosecution

Tax deductors, after deducting TDS from specified payments, are deliberately not depositing the taxes so deducted in Government account and continue to deploy the funds so retained for business purposes or for personal use. Such retention of Government dues beyond the due date is an offence punishable u/s 276B of the Income Tax Axt, 1961.rigirous…

-

TDS/TCS-Forms

TDS is one of the modes of collection of taxes, by which a certain percentage of amounts are deducted by a person at the time of making/crediting certain specific nature of payment to the other person and deducted amount is remitted to the Government account. It is similar to “pay as you earn” scheme also…

-

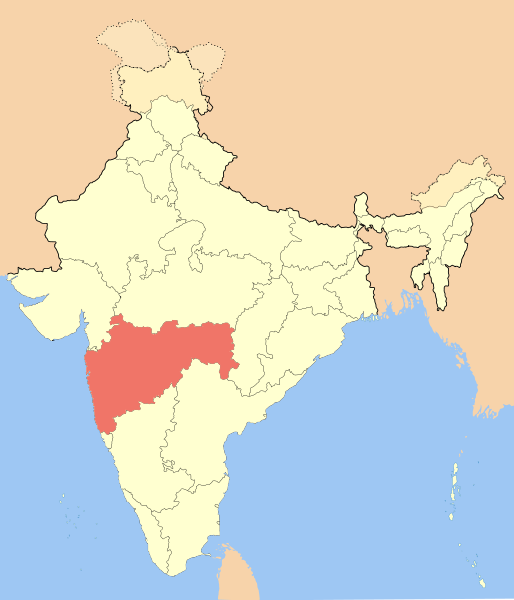

Maharashtra leading on number of e-return filing

Maharashtra is leading on number of e-Returns submitted as on 30th June 2013. A total of 2187712 e-Returns has been made by Maharashtra followed by Karnataka (963435) and Gujarat (939755).There has been an decline in number of e-Returns submitted as compared to previous financial years. Source: incometaxindiaefiling.gov.in/

-

number of e-filings declined

Even there is a mandatory requirement to e-filing of individuals whose total income exceeds Rs 5,00,000, total number of e-filings lags behind as compared with the financial year 2012-2013(21486807) with financial year 2013-2014(till 31st July) 10321775. When it comes to e-filing through ITR-1(salaried individuals), there is also a drop down of 628629 and it stands…

-

ITR e-filing exceeds 1 crore

Number of e-filing made exceeds 1 crore (10321775 as on 31st July, 2013),even there is a mandatory requirement to e-filing of individuals whose total income exceeds Rs 5,00,000, total number of e-filings lags behind as compared with the financial year 2012-2013(21486807). When it comes to e-filing through ITR-1(salaried individuals), there is also a drop down…

-

up coming Bank holidays

AUGUST Ramzan Id (Id-Ul-Fitr) 9 Independence Day 15 Raksha Bandhan 20 Sree Narayana Guru Jayanthi 22 Janmashtami/Krishna Jayanthi 28 SPETEMBER Ganesh Chaturthi/Varasidhi Vinayaka Vrata/Vinayakar Chaturthi 9 Ganesh Chaturthi 2nd Day 10 Thiruvonam 16 Sree Narayana Guru Samadhi Day 21 OCTOBER Mahatma Gandhi Jayanti 2 Mahalaya 4 Astami of Durgapuja 12 Durga Puja (Dasain)…

-

Overwhelming response for e-filing

The new rule making assesses having a total income of more than Rs 5,00,000 to file their return electronically(e-filing) results in an overwhelming increase of 40 % than the number of returns during the last year. More than 82 lakh returns have been e-filed till 29th July, 2013 out of which 6.23 lakh returns were…