Tag: cbdt

-

Conditions to get waiver of interest

Three conditions specified in Section 220 (2A) of the Income Tax Act should be cumulatively satisfied by an assessee to claim waiver of interest levied under Section 220 (2) of the Act.

-

Limit for e payment reduced to 1 lakh

Ministry of Finance (department of revenue),has reduced the threshold limit for payment of service tax to 1 lakh rupees. Previously it was Rs 10 lakh for e-payment. It shall come into force from 1st January 2014. It is observed that the move is towards encouraging tax compliances through online mode and thus to make formalities…

-

Deductions not allowed according to finance act 2013

Finance Act 2013 enlargened section 40 to exclude certain expences/payments under income from business/preofession-it includes privilege fees,service charge, service tax,etc…

-

FRINGE BENEFITS-2(23B)

Fringe Benefits are given in addition to salary/wage.it includes free or concessional ticket ,any contribution by the employer,provision of hospitality,any expenditure on or payment through paid vouchers which are not transferable,etc…

-

Tax Slab Rate of Senior Citizens

Find Out – Tax Slab Rate of Senior Citizens(60-79)

-

Hidden Benefits of housing loan you must read

Housing loan, in first instance it is like a burden to repay a certain amount to be paid in periodical intervals even though it is used for construction/purchase of house. But, when it comes to Tax calculation it will be beneficial to tax payer that, he can deduct the interest paid on account of housing…

-

Take advantage from housing loan interest!!

According to Income Tax Act, 1961 a person receiving income from house property can deduct certain amount under section 24 as standard deduction (other than municipal tax paid in the case of let out property) from the income from house property. Standard deduction prescribed under section 24 is as follows In the case of…

-

Deductions allowed from Income from House Property?

Any income received in related to house property is taxable. According to Income Tax Act, 1961 a person receiving income from house property can deduct certain amount under section 24 as standard deduction (other than municipal tax paid in the case of let out property) from the income from house property.

-

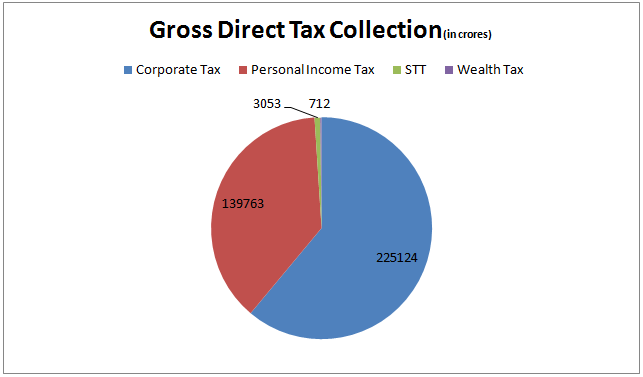

What is Gross and Net Tax Collection

In Tax collection reports,you may notice that amount of gross and net tax collection differs. The difference in gross and net collections is due to tax refunds. Income Tax Department will refund the excess tax paid on account of mistake/mis calculation by the tax payers.

-

What is major source of Tax Revenue

As tax collection increased during April-November of the Financial Year 2013-14, corporate tax contribute a major share to gross direct tax collection. Even during the period of sluggish market gross corporate tax collection amounts to Rs…..