Tag: cbdt

-

ITR-6 released

Companies not claiming exemption under section 11 (charitable or religious purpose) of Income Tax Act, 1961 has to file their return using ITR 6. All companies are mandatorily required to file their return on or before 30th September in order to free from penalty and other consequences. Companies should submit their return electronically using digital…

-

Deduction can be calimed on interest from savings account

Any interest income derived from deposits in a savings account (not time deposits) will be allowed as deduction. Interest income up to Rs 10,000 in aggregate shall be allowed as deduction while computing Total Income. Only individuals and HUF are entitled to claim deduction

-

Hurry! Last date for filing return July 31st

Assessee’s not required to compulsory audit has to file income tax return on or before 31st July 2013(for assessment year 2013-2014 financial year 2012-2013) .They can either file their return electronically or submit directly to income tax office. it is made mandatory to make e-filing for those assessee’s whose Total Income in the previous year…

-

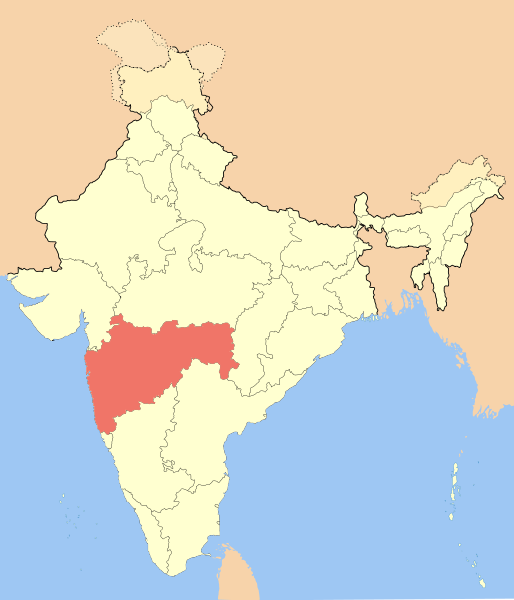

Maharashtra leading on number of e-return filing

Maharashtra is leading on number of e-Returns submitted as on 30th June 2013 followed by Gujarat

-

Sudha sharma new CBDT chairpeson

1976 batch IRS officer SUDHA SHARMA has been appointed as chairpeson of CBDT. Prior to the appoinment,sudha worked as Member (Legislation and Computerisation) in CBDT.