How Electrical Connectors Are Designed for Safety

Electrical connectors are designed with various safety features to guarantee reliable operation and protect you from hazards. They include polarized designs and locking mechanisms to prevent incorrect connections. Materials like copper and protective coatings enhance durability, while insulation protects against moisture. Adherence to safety standards guarantees connectors meet necessary electrical demands. Visual cues also guide you in making accurate connections. If you want to explore how these elements come together for maximum safety, there’s much more to discover.

Key Takeaways

- Electrical connectors often incorporate polarized designs to prevent incorrect connections and ensure safe usage across various applications.

- Safety standards are adhered to rigorously, ensuring connectors perform reliably and protect users from electrical hazards.

- Built-in features, like locking mechanisms and circuit breakers, enhance safety by minimizing accidental disconnections and overcurrent situations.

- High-quality materials that resist corrosion and environmental factors contribute to the longevity and safety of electrical connectors.

- Visual cues, such as color coding and labeling, guide users for safer and more accurate connections during operation.

Understanding Electrical Connectors and Their Functions

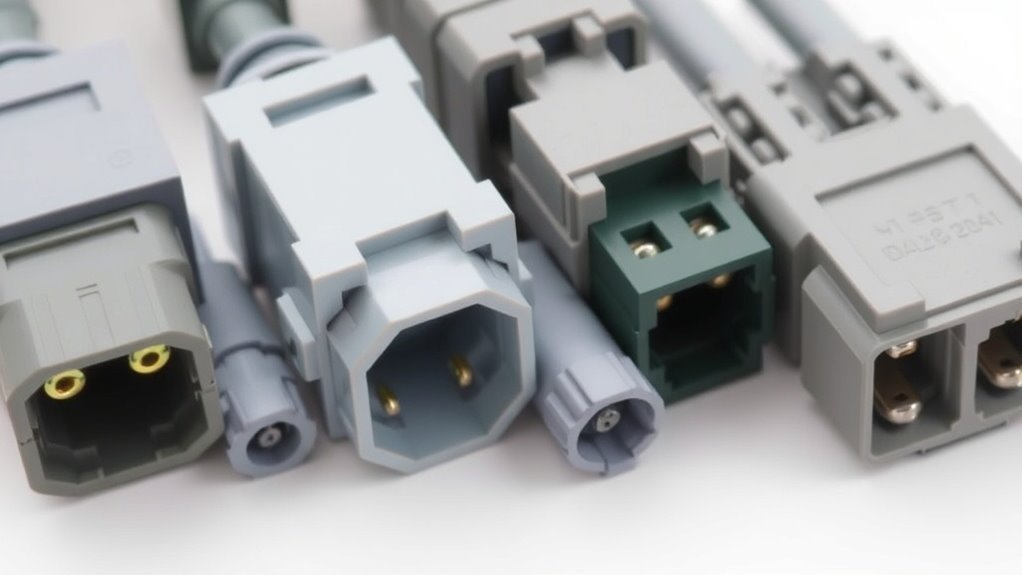

Electrical connectors are the unsung heroes of modern devices, enabling reliable connections between components. You mightn’t think about them often, but they’re essential for power transfer, signal transmission, and communication.

When you plug in your phone charger or connect your computer to a peripheral, you’re using a connector designed for specific functions. Each type serves distinct purposes, whether it’s a simple USB connector for data transfer or a more complex multi-pin connector for complex machinery.

Understanding these components helps you appreciate their importance in ensuring seamless operation. By recognizing the various types, including circular, rectangular, and modular connectors, you can better understand how they integrate within electronic systems to maintain efficiency and performance in your daily tech.

Importance of Safety Standards in Connector Design

When selecting the right connectors for your devices, safety should be at the forefront of your mind.

Adhering to established safety standards in connector design isn’t just a recommendation; it’s essential for preventing accidents and ensuring reliable performance.

These standards help you identify connectors that can withstand electrical demands, resist environmental factors, and maintain safe isolation between conductive parts.

Materials Used in Safe Electrical Connectors

Choosing the right materials for connectors is essential for ensuring safety and durability. Commonly used materials include copper for its excellent conductivity, but it’s also vital to contemplate corrosion-resistant coatings like tin or nickel to enhance longevity.

Additionally, using thermoplastics or thermoset resins for housings can provide outstanding insulation while withstanding environmental stressors. You might also encounter materials like rubber or silicone in seals, which protect against moisture and contaminants.

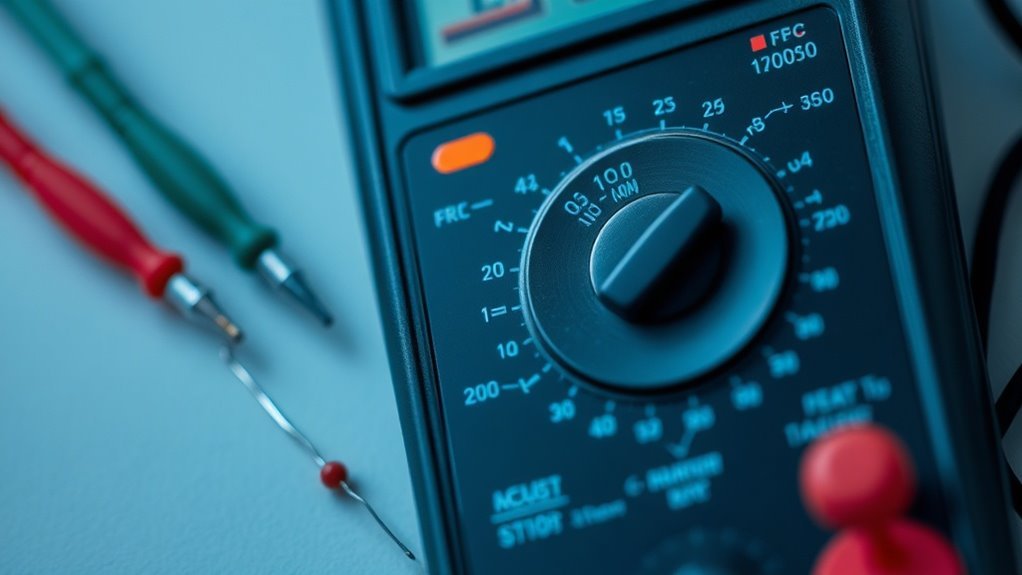

It’s important to balance conductivity, insulation, and environmental resilience when selecting materials. This helps prevent failures, overheating, and electrical hazards. Proper insulation in electrical tools plays a critical role in enhancing user safety and minimizing risk.

Innovative Designs for Enhanced Protection

With the right materials in place, the focus shifts to innovative designs that take protection to the next level.

You’ll find that features like locking mechanisms and improved sealing techniques play an essential role in preventing accidental disconnections and exposure to environmental hazards. Ergonomically designed shapes can enhance user experience while minimizing the risk of electrical arcing.

Additionally, color-coding and clear labeling guarantee proper identification, reducing installation errors. Incorporating adaptive technologies like thermal cutoff switches can also enhance safety, automatically shutting down connections in extreme conditions.

These designs showcase a commitment not just to functionality, but to user safety—making certain you can rely on connectors for peace of mind in any application.

Current Ratings and Their Role in Safety

When designing electrical connectors, understanding current ratings is essential for ensuring safety.

You need to take into account how overcurrent protection measures and thermal management will impact the longevity and reliability of your connectors.

Importance of Current Ratings

Although current ratings might seem like just another specification, they play an essential role in ensuring the safety and reliability of electrical connectors. By understanding the rated current, you can prevent potential hazards like overheating and electrical failure.

When you choose a connector, make sure its current rating aligns with your specific application requirements. Exceeding this rating can lead to overheating, which can damage components and create fire risks. You’re not just protecting the equipment; you’re ensuring the safety of everyone who interacts with it.

Overcurrent Protection Measures

While it’s essential to understand current ratings for electrical connectors, implementing effective overcurrent protection measures is equally important for guaranteeing safety. Overcurrent protection devices like fuses or circuit breakers play a significant role in safeguarding your electrical connectors. They help prevent excessive current flow that can lead to overheating, fires, or even connector failure.

When selecting connectors, consider their rated current and how it aligns with your application’s requirements. Confirm that overcurrent protection is tailored to handle anticipated load conditions without unnecessary tripping.

Regular testing of these protection devices can also enhance reliability. By focusing on appropriate overcurrent measures, you’re not just prioritizing performance—you’re fostering a safer environment for everyone involved.

Thermal Management Considerations

Thermal management plays an essential role in the safety and reliability of electrical connectors. When current flows through a connector, it generates heat due to resistance, and if this heat isn’t managed properly, you could face serious safety hazards.

High temperatures can lead to insulation failure or even connector degradation, which increases the risk of short circuits.

That’s why current ratings are vital—they help you choose the right connector for your specific application. Always pay attention to these ratings to guarantee that the connector can handle the expected load without overheating.

Incorporating adequate ventilation and using materials with good thermal conductivity can also support effective thermal management. By addressing these considerations, you can greatly enhance the safety and longevity of electrical connections.

Environmental Considerations in Connector Design

When you’re designing electrical connectors, you can’t ignore environmental factors.

Choosing the right materials and understanding ingress protection ratings are essential for ensuring longevity and reliability.

These considerations help prevent damage from moisture, dust, and other elements that could compromise safety. Additionally, insulation plays a crucial role in protecting against electrical hazards, ensuring safe operation in challenging environments.

Material Selection Standards

In today’s world, selecting the right materials for electrical connectors is essential for ensuring safety and performance. When it comes to material selection standards, you need to assess durability, thermal stability, and resistance to corrosion.

Metals like copper and aluminum are commonly used for their conductivity, but you’ll also want to evaluate their suitability for various environments. Plastics may be chosen for insulation, requiring attention to their flame-retardant properties and environmental stress.

Additionally, make sure the materials meet industry-specific regulations to guarantee they can withstand conditions like extreme temperatures or humidity. By following these standards, you can enhance the reliability and safety of your electrical connectors, minimizing the risks associated with failures.

Ingress Protection Ratings

How effectively can your electrical connectors resist environmental factors? Ingress Protection (IP) ratings provide an essential guide on how well your connectors can withstand exposure to solids and liquids. These ratings help you determine their suitability for different environments. The first digit indicates protection against solid objects, while the second reveals their waterproof capabilities.

| IP Rating | Description |

|---|---|

| IP67 | Dust-tight & submerged in water up to 1 meter for 30 minutes |

| IP65 | Dust-tight & protected against water jets from any direction |

| IP54 | Limited dust ingress & protected against water splashes |

Understanding these ratings guarantees you choose connectors that maintain functionality and safety in various conditions. Always assess your specific environmental needs.

User Interaction and Safety Features in Connectors

As users engage with electrical connectors daily, the importance of intuitive design and robust safety features becomes clear.

You’ll often encounter connectors that require minimal effort to understand and operate. Features like polarized designs prevent incorrect connections, guaranteeing safety and functionality. Furthermore, many connectors include locking mechanisms that reduce accidental disconnection, providing peace of mind during use.

Visual cues, such as color coding or clear labeling, can also guide you in making the right connections.

Visual cues like color coding and clear labeling simplify the connection process, ensuring accuracy and safety every time.

Additionally, some connectors incorporate built-in fuses or circuit breakers, which protect both the device and user from potential electrical hazards.

These user-centric designs not only enhance your experience but also guarantee that you can interact safely with electrical systems, minimizing risks and maximizing reliability.

Questions

How Do Electrical Connectors Prevent Short Circuits During Operation?

Electrical connectors prevent short circuits by using insulating materials, secure connections, and guaranteeing proper alignment. They’ve designed features like keying and locking mechanisms to guarantee the right orientation, minimizing risks during operation and enhancing safety.

What Testing Methods Ensure Connector Safety and Compliance?

Imagine the calm before a storm — testing methods like thermal cycling and voltage testing guarantee connectors withstand extremes, preventing failure. You’ll feel secure knowing they’ve passed stringent compliance checks before being used in critical applications.

Are There Specific Regulations Governing Connector Safety Designs?

Yes, there’re specific regulations like IEC standards that govern connector safety designs. These guarantee connectors meet safety, reliability, and performance criteria, helping you choose safe options for your electrical applications and preventing potential hazards.

How Often Should Connectors Be Inspected for Safety?

Think of connectors like tire tread; regular checks keep you safe. You should inspect them every six months or more frequently if they’re used heavily. Keeping an eye on them prevents potential accidents down the road.

What Role Do Manufacturers Play in Connector Safety Assurance?

Manufacturers guarantee connector safety by adhering to strict standards, conducting tests, and implementing quality control measures. They also provide detailed guidelines for usage, helping you understand best practices to maintain safety throughout the product’s lifecycle.

Conclusion

In crafting safe electrical connectors, designers weave a tapestry of functionality and protection, ensuring users are shielded from potential hazards. By adhering to strict safety standards and utilizing innovative materials, they’re like guardians in our daily lives, quietly working to prevent accidents. As you plug in or unplug, remember that each connector embodies countless hours of design, aimed at making sure your electrical experience is not just efficient but also safe. Stay connected, safely!